February 28, 2023 | Industry News

March 2023 Regional Market Report News

Crop Updates

Escargot

Poor weather conditions out of Asia and France are causing a substantial deficit in extra-large and giant snail yields. Snail farmers are reporting the snails are not growing at their normal rate, which leaves farmers hesitant to harvest. In turn, the average yield is producing overall smaller snails in limited quantities. The current supply of all other snail varieties has not been impacted.

Our partners have provided us with advanced insight into the issue and predicted that this trend will likely continue to progress into the coming year. While this impact is anticipated to be limited to the supply of extra-large and giant snail items, Roland Foods is monitoring the situation to ensure that we are equipped to provide a continuous supply of snail products to our customers.

Dijon Mustard

Finished Dijon mustards have been severely impacted by the poor 2021 summer harvest of mustard seeds, where yields were 60% lower than historical averages, causing a near 2-year shortage.

However, the mustard seed harvest began to improve in 2022, and we continue to see progress in the early months of 2023. With this improvement, we expect to regain control of the crop in hopes of it being fully recovered by April 2023. With this promising prediction, we will continue to work diligently yet cautiously with our partners to stay ahead of any challenges that may present in the coming months.

Global Supply Chain and Logistics Updates

January Import Volumes Identical to 2019 & 2020

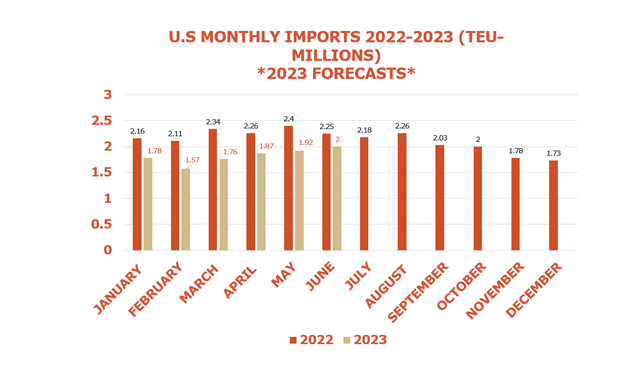

February, March, and April are typically slow months in the transportation industry. Since 2020, there has been a disruption in this cycle, with record high import volumes reaching all corners of the U.S during this period. However, it appears that 2023 is on track to reset levels back to a pre-pandemic norms, with container import numbers for January 2023 almost identical to those of January 2019 and 2020. Shipping lines also anticipate they will remain soft through the early spring months, indicating a return to normalcy.

The chart below was published National Retail Federation and Hackett’s Maritime Strategy and illustrates the projected import volume for the first half of 2023 compared to 2022 actual figures.

Although it is expected global trade will contract in 2023, there is still uncertainty how challenging the global supply chain will be and to what degree consumer spending will regress.

Many retailers are holding onto high levels of inventory and seem to be cautious about placing large orders until inflation wanes. Another uncertainty causing concern are the labor negotiations in the West Coast between the ILWU and truck drivers, currently affected by California’s new AB5 law. Until these labor issues are resolved, shipping lines will be wary about sailing to the West Coast, complicating the flow of goods through our domestic supply chain.

At Roland Foods we are aware there may be more challenging times ahead, but we will work to maintain a flexible and responsive transportation network capable of adapting to any environment.

Source: Descartes